Reborn in the USA: How Reshoring May Benefit Small-Cap Stocks

Many companies are bringing their supply chains and operations back to the U.S. after the pandemic.

Key Takeaways

COVID-19 accelerated the business trend of returning jobs and operations to the U.S.

Supply chain, intellectual property and environmental, social and governance (ESG) issues support reshoring.

We think small-cap firms may benefit significantly from positive reshoring impacts across the U.S. economy.

Panasonic will open the most significant private investment in Kansas history in less than a year.

The company’s $4 billion lithium-ion battery plant in De Soto, Kansas, an exurban town near Kansas City, is expected to create 4,000 direct jobs and 8,000 jobs in various supporting sectors (e.g., retail, hospitality, construction).

Panasonic already operates a joint battery plant with Tesla in Nevada and is reportedly exploring a third battery plant, though the location and timeline are uncertain.

In April, chipmaker TSMC said it reached a preliminary agreement to receive $6.6 billion in direct funding from the U.S. Department of Commerce to build a third fabrication plant in Arizona, given the soaring demand for semiconductors.1

Last year, Micron Technology said it would build a $20 billion chip factory in New York, an investment that could grow to $100 billion and create 50,000 jobs for the region.2

What do these projects have in common? They’re all being built in the U.S. instead of China, Vietnam or elsewhere.

These projects and dozens more mark the return of manufacturing and supply chains to the U.S. after decades of offshoring as companies sought cheaper labor and increased global trade.

Reshoring has created hundreds of thousands of jobs in the U.S., and we believe this trend may benefit small-cap companies.

Understanding the Historical Context and Current Wave of Reshoring in the U.S.

Reshoring began over a decade ago, as domestic companies and foreign direct investment gradually added jobs to the U.S. workforce.

However, the COVID-19 pandemic hastened this trend by exposing vulnerabilities in global supply chains. For example, the pandemic revealed America’s reliance on China, where the virus started and spread rapidly, causing the shutdown of many factories and production facilities. Shipping costs also soared, and while U.S. ports are no longer as congested, overseas shipping delays remain routine compared with pre-pandemic schedules. As the pandemic unfolded, nearly 70% of domestic manufacturers considered bringing production back to North America.3

Some companies accelerated their reshoring efforts in response to national security threats from supply chain risks. This was driven by the apprehension that China's potential military action against Taiwan, a leading semiconductor producer, could disrupt U.S. access to these critical components. This scenario underscores the need for increased domestic capacity to manufacture the semiconductors essential for electronic devices.

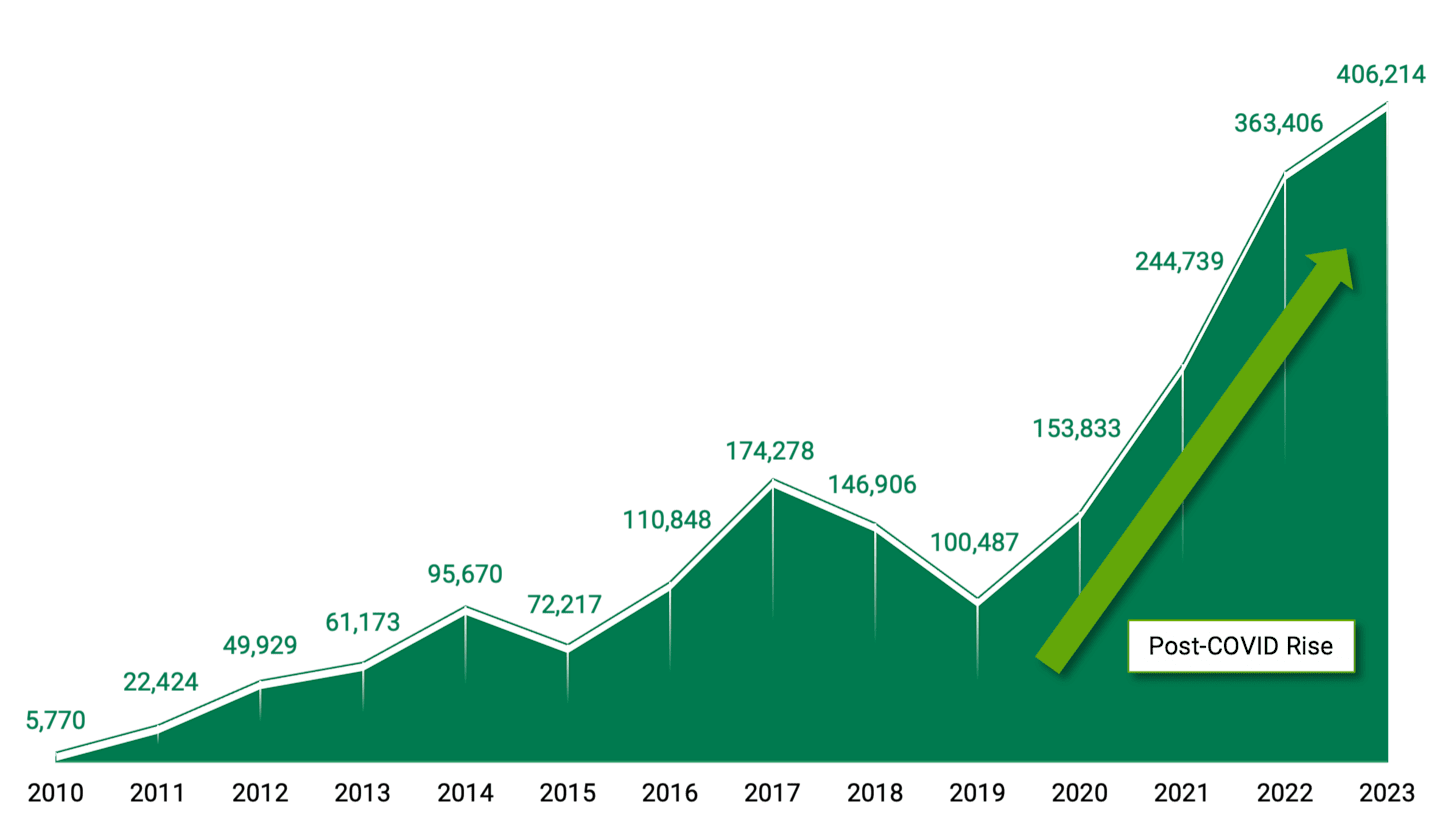

Since the beginning of 2020, reshoring has brought back more than 1.1 million jobs to the U.S., exceeding the number of jobs generated from 2010 to 2019. See Figure 1.

Figure 1 | Bringing Jobs Back to the U.S.

Data from 2010 – 2022. The data for 2023 is estimated. Source: The Reshoring Initiative. Figures represent job announcements from production brought back to the U.S. and from foreign direct investment.

A whopping $1.1 trillion in government funds have already been made available through the Bipartisan Infrastructure Law, the Inflation Reduction Act, the CHIPS Act and the American Rescue Plan, all of which can support reshoring initiatives. However, according to research by Politico and Raymond James, less than 20% of this funding has been spent so far.

We believe Congress will likely continue supporting reshoring efforts due to their bipartisan appeal, regardless of the outcome of November’s elections.

Mitigating Risks: Reshoring’s Impact on IP, National Security and Sustainability

Shipping and supply chain considerations don’t fully explain reshoring’s broader appeal. Companies in many industries, especially technology, aerospace, defense and pharmaceuticals, must closely guard their intellectual property (IP) in a world susceptible to hacking and outright theft.

Even before the coronavirus, up to 20% of North American corporations claimed China had stolen their intellectual property. The FBI estimates that counterfeit goods, pirated software and trade secret theft cost the U.S. economy up to $600 billion annually.4

National security concerns also make reshoring a priority for the federal government. The U.S. has been particularly concerned about the possibility of China invading Taiwan, a close U.S. ally in East Asia. In May, Reuters reported that China simulated amphibious assaults, as well as maritime and air blockades, against Taiwan in 2023.5 Taiwan is a top producer of semiconductors, an essential component in virtually any type of electronic device, so the prospect of a Chinese takeover of Taiwan would leave the U.S. vulnerable to chip shortages.

These concerns and IP theft led to the bipartisan passage of the U.S. CHIPS and Science Act, prioritizing U.S. leadership in the semiconductor industry. The law aims to provide $280 billion in subsidies for manufacturers producing chips domestically in the next decade.

Environmental, social and governance (ESG) considerations, ranging from labor practices to carbon emissions, have also pushed more companies to produce materials and products in the U.S. The federal government has tighter regulations and laws protecting labor rights and the environment than many other nations, attracting buyers focused on ESG standards in their supply chains.

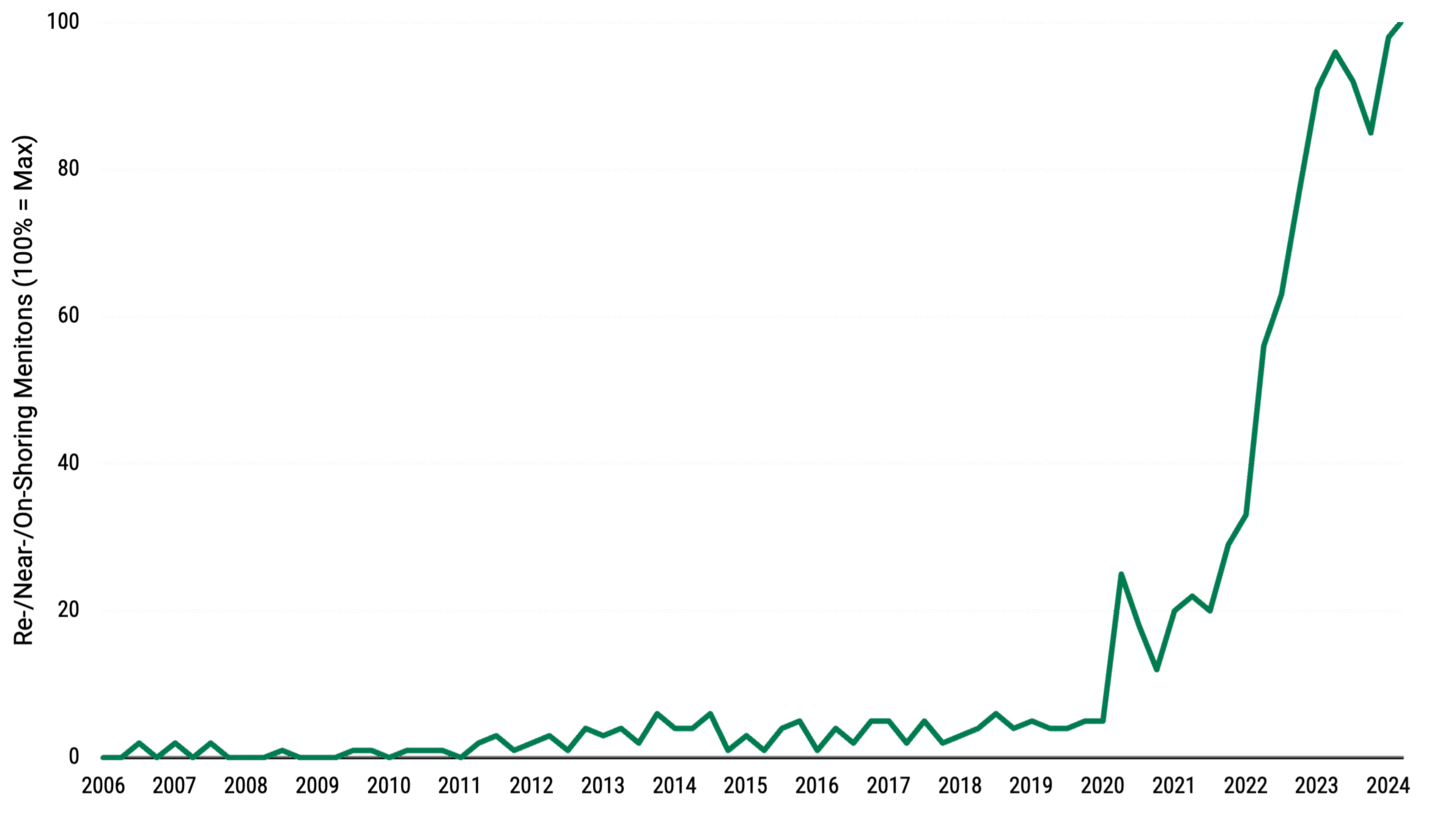

An Ernst & Young survey found that 80% of supply chain executives are increasing their efforts to build sustainable supply chain operations.6 Executives frequently discuss this issue during quarterly earnings calls with investors and analysts. See Figure 2.

Figure 2 | Everyone Is Talking About Reshoring

Data from 3/31/2006 - 5/31/2024. Source: BofA U.S. Equity & Quant Strategy, AlphaSense.

Automation has helped offset lower overseas labor costs, and trade tensions exacerbated by the Russia/Ukraine war and China’s tightening authoritarian policies have helped reshoring gain further traction.

U.S. consumers also tend to respond well to the “Made in the USA” label, as evidenced by Walmart’s intention to spend $350 billion on items grown, made or assembled in the U.S. through 2030.7

Impact of Reshoring on Small-Cap Firms and Economic Growth

The Economic Policy Institute estimates that every manufacturing job that returns to the U.S. generates seven new jobs in supporting industries. This includes everything from more regional banks for lending to more housing for workers and more restaurants to serve them. Smaller yet significant multiplier impacts are evident for reshored information technology, professional, transportation, construction and service jobs.

But reshoring costs are significant. Bank of America estimates that U.S. and European companies could spend as much as $1.2 trillion as they attempt to secure greater control of their supply chains and production operations.8 These corporate costs primarily come from capital expenditure (CapEx) budgets, and revenue growth at small-cap companies is highly correlated with CapEx growth in the overall U.S. economy.

U.S. small-cap companies typically exhibit more sensitivity to the economy than their large-cap counterparts, so we think they are poised to reap the biggest benefits from reshoring. Since 1985, sales growth for U.S. small-cap firms shows an 85% correlation with CapEx growth for firms in the Russell 2000® and S&P 500® indices, compared with 76% from large-cap firms.9

At the same time, U.S. job growth disproportionately helps U.S. small-cap firms, as they derive 82% of their revenues, on average, within the country. By comparison, U.S. large-cap firms garner 61% of their revenues from U.S. sources.10

Economic Benefits and Impacts of Reshoring on the U.S. Economy

From a broader perspective, reshoring has a key drawback for the U.S. economy and the stock market.

In aggregate, reshoring may worsen inflation. Its widening appeal to U.S. companies could heighten borrowing costs for an extended period if the Federal Reserve (Fed) continues to hold rates higher for longer in its fight to combat inflation. While inflation has cooled since 2023, the Fed hasn’t yet started cutting rates as inflation readings remain stubbornly above its target 2% range.

However, small-cap stocks have tended to outperform large-cap stocks most significantly at times when inflation exceeded the Fed’s 2% inflation target.11

In our view, reshoring will continue regardless of its impact on the financial markets and the economy. It has specific tangible benefits for a broad range of U.S. companies, especially small-cap firms.

And while investors may not reap immediate benefits, we believe reshoring could potentially accelerate revenue and earnings growth for small-cap companies throughout the next decade.

Author

TSMC, “TSMC Arizona and U.S. Department of Commerce Announce Up to $6.6 Billion in Proposed CHIPS Act Direct Funding,” Press Release, April 8, 2024.

Micron Technology, “Micron Announces Historic Investment of up to $100 Billion to Build Megafab in Central New York, Press Release, October 4, 2022.

Cathy Ma, “Manufacturer Interest in Reshoring, Hiring, and Apprenticeships Increasing During COVID-19 Pandemic,” Thomas Insights, July 14, 2020.

Eric Rosenbaum, “1 in 5 corporations say China has stolen their IP within the last year: CNBC CFO survey, CNBC, March 1, 2019; Nicole Sganga, “Chinese hackers took trillions in intellectual property from about 30 multinational companies,” CBS News, May 4, 2022.

Peter Hobson and Lewis Jackson, “Chinese Military Practiced Taiwan Invasion Manuevers in 2023, Says U.S. General,” Reuters, May 22, 2024.

Rae-Anne Alves and Glenn Steinberg, “How sustainable supply chains are driving business transformation,” EY Insights, September 20, 2022.

John Furner, “Investing in the Future of U.S. Manufacturing, Our Commitment to American Jobs,” Walmart Press Release, March 3, 2021.

Elliot Smith, “U.S. and European firms face $1 trillion in costs to relocate their Chinese supply chains, BofA says,” CNBC, August 18, 2020. Figure adjusted for inflation.

Jill Carey Hall, Nicholas Woods, and Vivek Arya, et al., “Back to the USA Take 2: Reshoring Update and Who Benefits,” SMID Cap Focus Point, BofA Global Research, August 15, 2022.

Catherine Yoshimoto, “Revenues without borders: Tracking U.S. companies’ cashflows, FTSE Russell, April 29, 2022.

Global Alpha, “Small cap is back: 7 reasons to buy small caps in a recession,” Commentary, November 17, 2022.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Many of American Century's investment strategies incorporate sustainability factors, using environmental, social, and/or governance (ESG) data, into their investment processes in addition to traditional financial analysis. However, when doing so, the portfolio managers may not consider sustainability-related factors with respect to every investment decision and, even when such factors are considered, they may conclude that other attributes of an investment outweigh sustainability factors when making decisions for the portfolio. The incorporation of sustainability factors may limit the investment opportunities available to a portfolio, and the portfolio may or may not outperform those investment strategies that do not incorporate sustainability factors. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and for certain companies such data may not be available, complete, or accurate.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.